The IMF has released its World Economic Outlook Update for July 2025.

Washington, DC, July 29, 2025 — Pierre-Olivier Gourinchas, Economic Counsellor and Director of the Research Department at the IMF, made the following remarks on the July 2025 IMF World Economic Outlook Update.

According to the IMF, the global economy is facing a tenuous resilience amid persistent uncertainty. Recent developments in international trade continue to impact the economic outlook.

In April, there was a significant increase in tariffs imposed on various countries worldwide. However, the United States has partially reversed its position by pausing the higher tariffs for most of its trading partners. Additionally, a decrease in trade tensions with China in May has led to a modest reduction of the U.S. effective tariff rate from 24% to approximately 17%.

While these changes are encouraging, tariffs remain historically high, and global policy uncertainties persist, with only a limited number of countries having established comprehensive trade agreements.

Despite the fragility of this modest reduction in trade tensions, it has contributed to the resilience of the global economy so far.

Several recent developments have contributed to changes in the economic landscape:

First, concerns about potential future tariffs resulted in a significant increase in exports to the U.S. during the first quarter of the year. This front-loading of exports helped bolster economic activity in Europe and Asia.

Second, financial conditions have improved, and monetary conditions have eased as global inflation continues to decline, remaining largely consistent with previous IMF projections.

Third, the value of the dollar has depreciated by approximately 8 percent since January. As the IMF noted in April, the impact of tariffs on exchange rates can be complex. In past instances, the country imposing tariffs often experienced a stronger currency, which mitigated the tariffs’ effects. However, this time, the depreciation of the dollar has intensified the impact of the tariff shock on the competitiveness of other countries. While the Chinese renminbi (RMB) has maintained a stable value relative to the U.S. dollar, the euro has appreciated significantly.

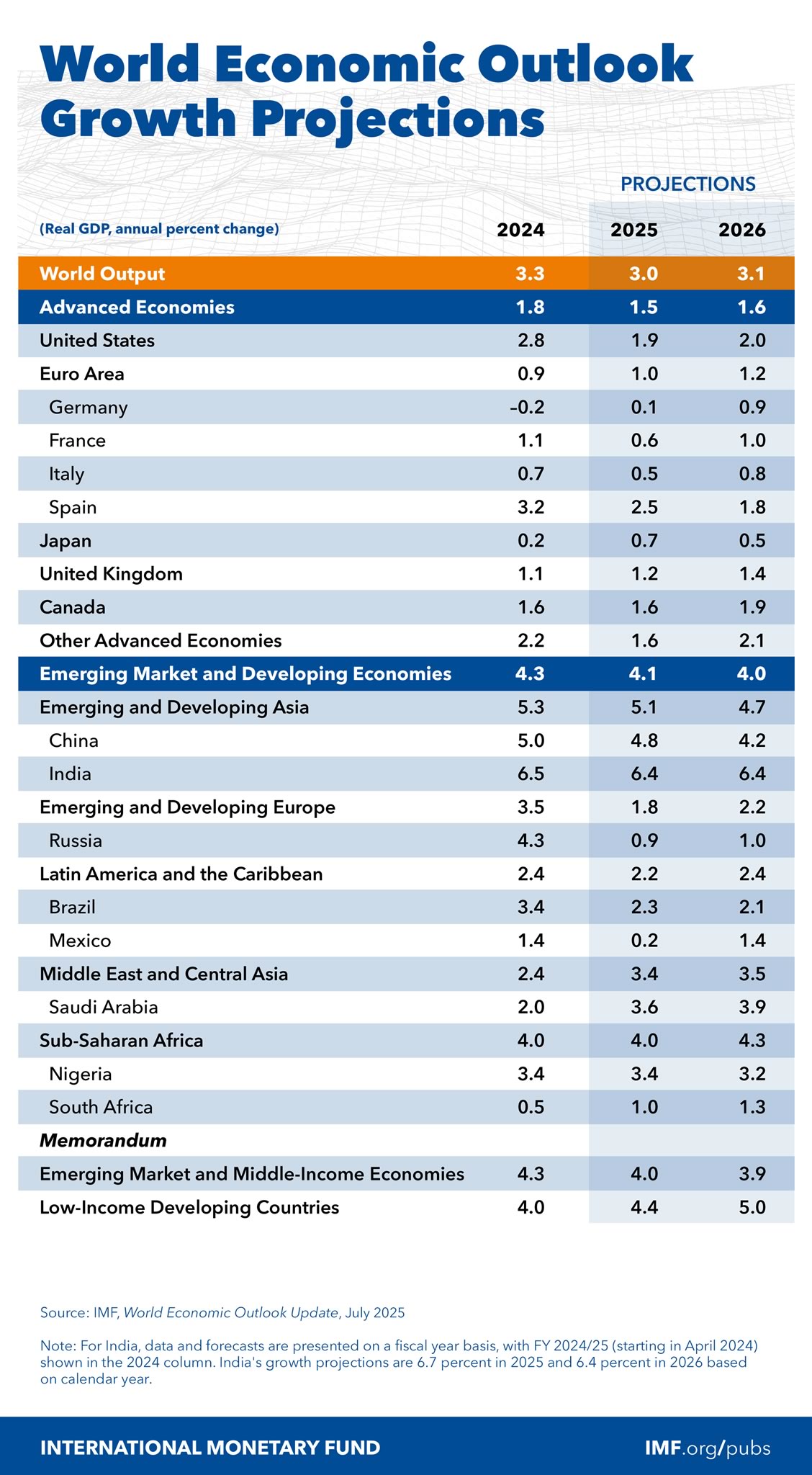

“As a result, we have revised our growth projections upward from our April 2025 reference forecast: we now anticipate growth of 3.0 percent this year, up from 2.8 percent, and 3.1 percent next year, an increase from 3.0 percent, “Mr. Gourinchas said.

Most regions are seeing modest growth upgrades this year and next.

This resilience is encouraging, but it is also fragile. Although the trade shock may turn out to be less severe than initially feared, it is still significant, and there is increasing evidence that it is negatively impacting the global economy. For example, compared to our forecast from before April 2, we have revised global growth downwards by 0.2 percentage points for this year. At around 3 percent, global growth remains disappointing and below the pre-COVID average.

The IMF also projects a continued decline in global trade as a share of output, decreasing from 57% in 2024 to 53% in 2030, despite the recent front-loading of trade activities.

Risks to the global economy remain firmly tilted to the downside. The current trade environment is precarious. Tariffs could be reset at much higher levels once the current pause expires on August 1, or if existing trade agreements unravel. If this happens, simulations suggest that global output could be 0.3 percent lower by 2026.

Without comprehensive agreements, ongoing trade uncertainty could increasingly impact investment and overall economic activity.

Additionally, while the front-loading of exports has supported global activity thus far, companies might become vulnerable if the anticipated demand for stockpiled goods does not materialize.

The geopolitical landscape is also fragile, with the potential for more negative supply disruptions.

While global inflation is continuing to decline, the latest price data indicates that inflationary pressures are gradually building in the U.S. Overall, U.S. import prices in dollars have either remained stable or even increased this year. It suggests that retailers in the U.S. will bear the cost of tariffs, which may eventually lead to higher prices for consumers as businesses begin to pass on these increased costs.

In many countries, the combination of high public debt and persistent public deficits remains a significant concern. The limited fiscal capacity makes these nations particularly vulnerable to a sudden tightening of financial conditions, which can elevate term premiums.

Such tightening becomes even more probable if central bank independence—an essential element of macroeconomic, monetary, and financial stability—is compromised.

Regarding policy recommendations, the IMF continues to advocate for prudence and enhanced collaboration.

Key priorities:

“First and foremost, restoring stability in trade policy is essential to reduce uncertainty. We urge all parties to resolve trade disputes and establish transparent and predictable frameworks. Collective efforts should focus on restoring and improving the global trading system.

“The need for predictable and stable rules extends to other areas of policymaking as well. It is crucial to reaffirm and preserve the principle of central bank independence. There is overwhelming evidence that independent central banks, with a narrow mandate to pursue price and economic stability, are vital for anchoring inflation expectations. The fact that central banks worldwide managed to achieve a successful ‘soft landing’ despite the recent surge in inflation can largely be credited to their independence and hard-earned credibility.

“Restoring fiscal space remains a priority for many countries. Even as new spending needs arise, efforts must be made to implement gradual and credible consolidation while protecting economic growth.

“Lastly, as global growth remains sluggish, we must increase efforts to boost long-term productivity through structural reforms,” Mr. Gourinchas concluded.

Source: International Monetary Fund (IMF)

— The Editor of CitiTimes holds an Academic Certificate from the International Monetary Fund (IMF).