The IMF has released its April 2025 Global Financial Stability Report.

Washington, DC, April 22, 2025 — According to the International Monetary Fund (IMF), global banking and financial markets are currently experiencing low volatility as central banks have begun to ease interest rates after successfully aligning inflation levels with their targeted objectives.

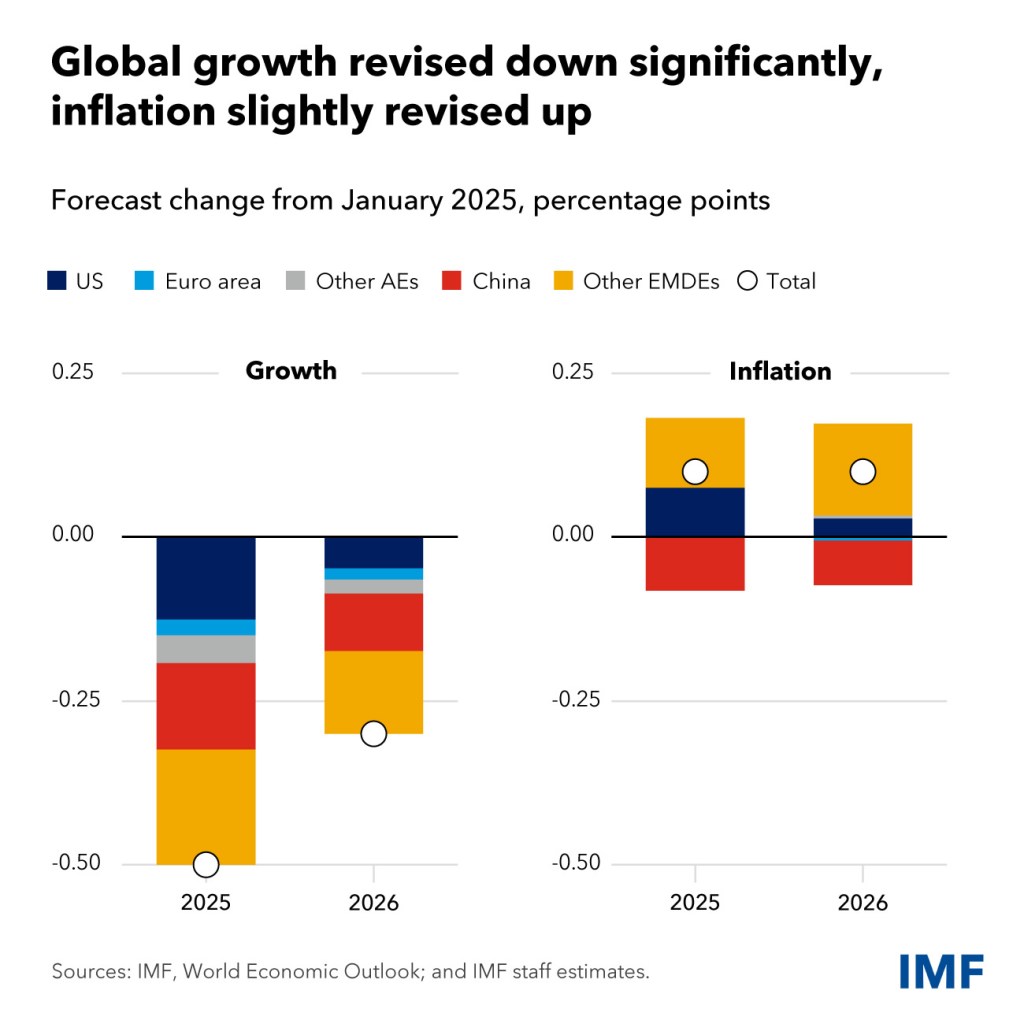

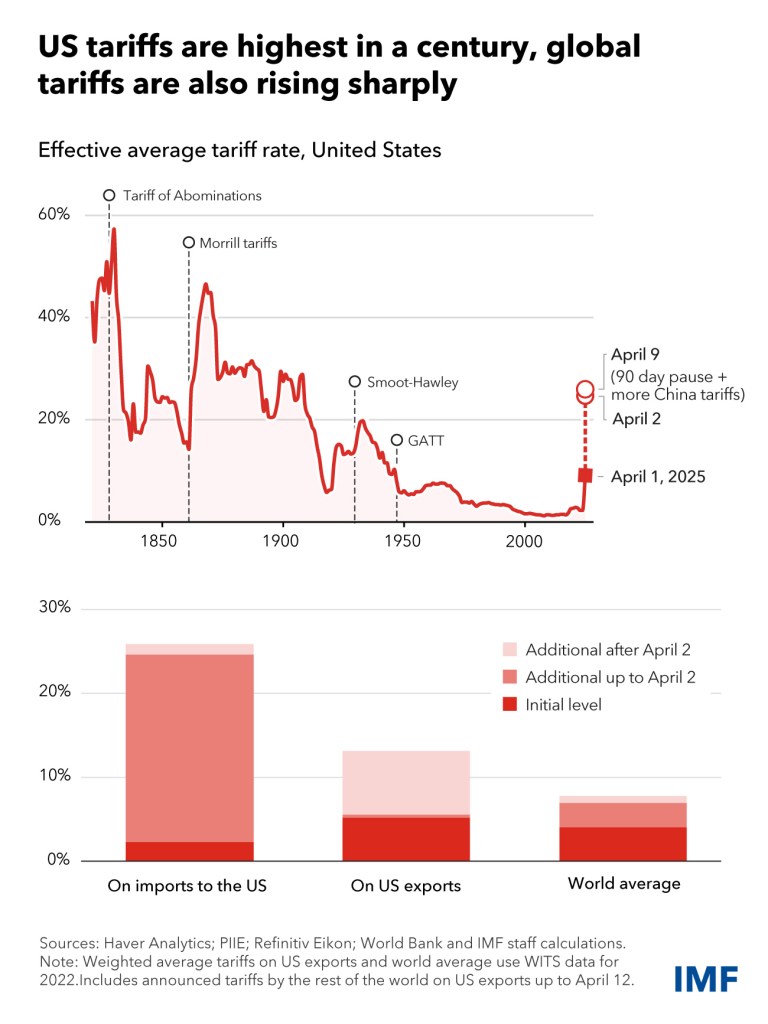

However, the IMF Financial Counselor Tobias Adrian warned, “Our assessment indicates that the risk to global financial stability has significantly increased due to heightened economic policy uncertainty and rising market volatility. The decline in investor confidence has led to recent sell-offs in equity markets. Additionally, tightening global financial conditions put downward pressure on economic activity.”

The assessment appears in the Global Financial Stability Report from the Fund, released during the week of the IMF and World Bank Group’s Spring Meetings.

“We observe three potential vulnerabilities that may affect the future. Despite the recent market turmoil, certain asset valuations remain high. If the economic outlook continues to worsen, these valuations could decrease further, resulting in tighter global financial conditions. Such tightening may negatively impact currencies, asset prices, and capital flows to emerging markets,” said Adrian before the report’s release.

“Financial conditions have changed from being generally accommodative to neutral, with the possibility of further tightening ahead. In times of prolonged volatility, highly leveraged financial institutions may face considerable stress. Non-bank financial institutions might also struggle during market turbulence, which could affect the broader financial system. Vulnerabilities could reemerge in weaker and poorly managed banks,” Adrian warned.

“Further turbulence could impact sovereign bond markets, especially in regions with high government debt levels. Volatility may increase if market conditions become strained in major advanced economies, coupled with the unwinding of leveraged trades in key sovereign bond markets. Emerging market economies, which are already facing the highest real financing costs in a decade, may need to refinance their debt and cover fiscal expenditures at higher rates. As a result, concerns among investors regarding public debt sustainability and vulnerabilities within the financial sector could intensify,” Adrian said before the report’s release.

What steps should policymakers take to ensure financial markets remain stable and resilient?

“It is essential to prepare for potential challenges by equipping authorities to manage financial instability effectively. The policy toolkit should include measures that ensure the proper functioning of markets, support prudent supervision and regulation of financial institutions, and provide tools for emergency liquidity and crisis resolution. We recommend that financial institutions and regulators allocate resources to identify and mitigate risk by employing stress testing and scenario analysis. Emerging markets and developing economies should focus on enhancing their financial markets while maintaining adequate fiscal policy space and international reserves to protect against geopolitical shocks.”

Source: IMF